RATIO ANALYSIS 202: THE COMPLETE BEGINNER’S GUIDE [ PART - 2 ]

WHAT IS IN ?

Hello guys!

Welcome back — in this article, we're diving into Part 2 of Ratio Analysis!

If you haven’t checked out Part 1 yet, I highly recommend reading that first. Just click the button below — because I’ve already explained most of the fundamentals and basics there.

Once you're done with Part 1, jump back here and continue your learning journey!

So without wasting a single second... let’s get straight into the article!

TYPES OF FINANCIAL RATIO

Financial ratios are divided into five main types:

Profitability Ratios

Liquidity Ratios

Turnover Ratios

Solvency Ratios { Leverage ratio}

Valuation Ratios

In the previous article Part 1, we already covered all the key profitability ratios.

Now in Part 2, we’re gonna explore all the important leverage ratios, and yes, we’ll continue with the same real-world example of Tata Motors vs Maruti Suzuki, so it's easier for you to connect the dots and understand better.

So, what exactly is a Leverage Ratio?

While analyzing any company, the sole purpose of leverage ratios is to understand how well the company is using debt to run and grow its business.

In very simple terms, leverage ratio tells us how efficiently the company is utilizing debt to maximize its revenue and profit.

It also acts as a warning signal, helping us spot if the company is not managing or utilizing its debt properly, which could lead to financial stress in the future.

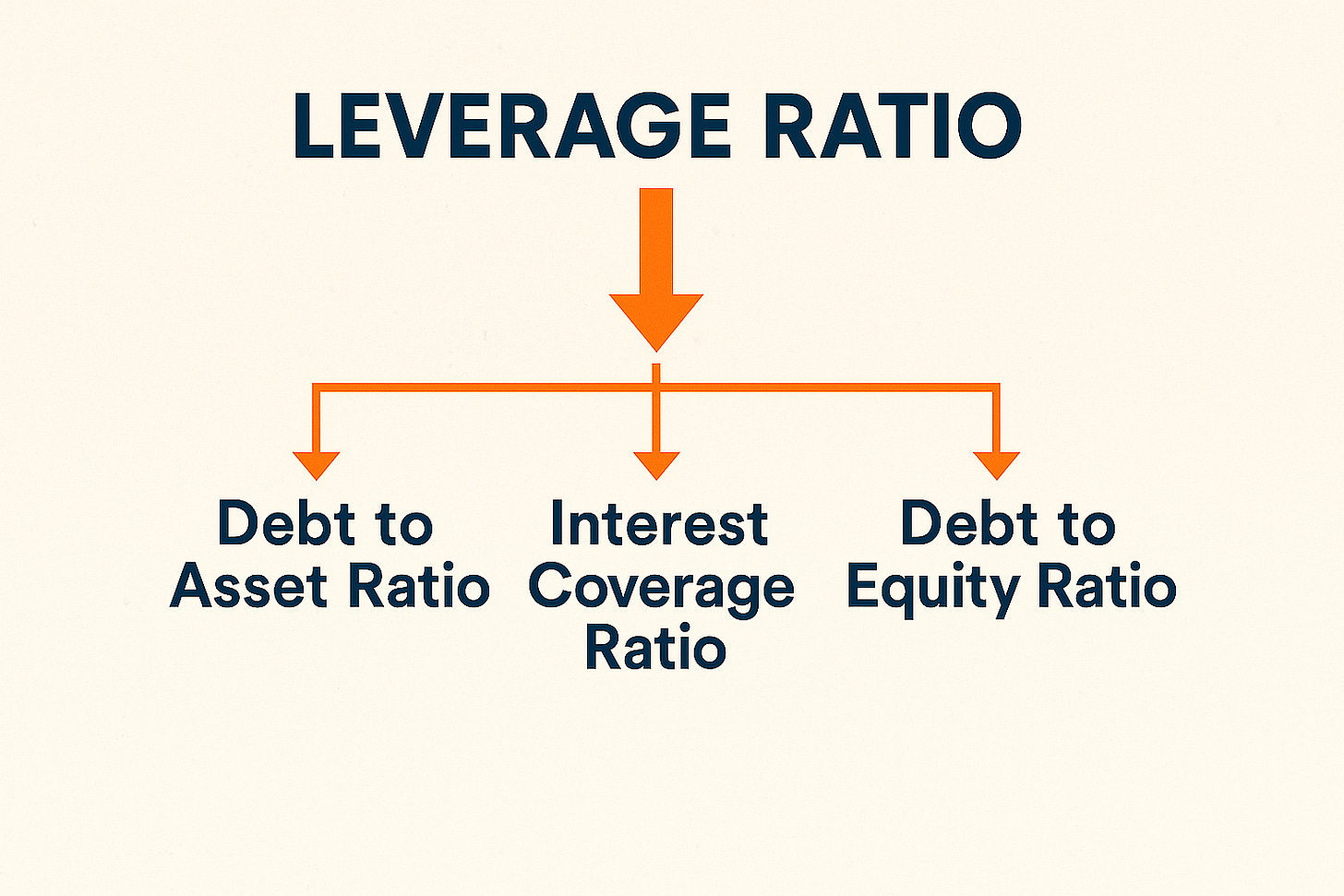

Now here’s the key part — leverage ratios are mainly divided into 4 important types:

Debt to Asset Ratio

Interest Coverage Ratio

Debt service coverage ratio

Debt to Equity Ratio

And trust me, all these 4 ratios are super important.

I’ll also include a chart below for better understanding.

Now let’s dig into each one, one by one.

If you want to read the full article of Part 2 of the Ratio Analysis, just click the button below and become a paid subscriber. You’ll get access to all premium articles, upcoming ones, and also join an exclusive WhatsApp group for deep discussions and updates.

Keep reading with a 7-day free trial

Subscribe to weekly’s Substack to keep reading this post and get 7 days of free access to the full post archives.