MANAGEMENT HISTORY

In 1981, a visionary named V.C. Nannapaneni embarked on a remarkable journey to create a pharmaceutical company that would redefine access to affordable medicines. With an initial investment of ₹3.3 million and a team of just 20 employees, Natco Pharma Limited was founded in Hyderabad, Telangana.

V.C. Nannapaneni, with a deep understanding of the pharmaceutical industry and a passion for providing high-quality medicines, laid the foundation for Natco Pharma. He envisioned a company that could bridge the gap between innovative treatments and affordability, especially in India, where expensive patented medicines were often out of reach for the common man.

From the early days, Natco Pharma invested in innovation and growth. Over the years, the company expanded its footprint across India, establishing eight manufacturing facilities and modern R&D laboratories. By focusing on niche segments like oncology and high-value generics, Natco steadily built its reputation as a company that challenged industry norms while making healthcare accessible to millions.

In 2000, V.C. Nannapaneni’s son, Rajeev Nannapaneni, joined the company, bringing with him a global perspective and modern business strategies. With a B.A. in Quantitative Economics and History from Tufts University, Rajeev initially focused on new business development and international markets. Over time, he assumed the role of CEO, driving Natco into a new era of growth and innovation.

A pivotal moment in Natco's history came in 2012 when the company was granted a compulsory license for Bayer's patent-protected anti-cancer drug, Nexavar, by the Government of India. This landmark decision underscored Natco's commitment to making life-saving medications more accessible and affordable.

Analysis of natco pharma balance sheet and financial performance

Let’s break down one of the most important aspects of Natco Pharma’s financial health—Total Current Assets and Total Current Liabilities. These numbers reveal a lot about how well the company is managing its short-term resources and obligations.

For those unfamiliar, current assets are resources that can be used or turned into cash within a year, like inventories and receivables. Meanwhile, current liabilities are obligations that need to be settled within the same period, like payables and short-term debt. In simple terms, these are the tools and costs a company uses for its day-to-day operations.

Here’s the golden benchmark: a strong balance sheet has current assets at least twice the current liabilities. This shows the company is not only liquid but also capable of easily meeting its short-term obligations.

Now, let’s analyze Natco Pharma’s performance:

Back in 2019, Natco had total current assets of ₹2,347 crore and total current liabilities of ₹728 crore. That’s a ratio of over 3:1, putting the company in a rock-solid position.

Fast forward to 2024, and Natco has elevated its game even further. Total current assets surged to ₹4,023 crore, nearly double what they were in 2019. On the other hand, total current liabilities increased modestly to ₹972.8 crore, up by only ₹244 crore in five years.

Analyzing this growth reveals Natco Pharma’s remarkable financial discipline. While total current assets nearly doubled over five years, the increase in current liabilities was modest—rising by only ₹244 crore. This controlled growth in liabilities, combined with a significant rise in assets, reflects strong financial management and operational efficiency.

The next critical factor to evaluate is borrowings, and Natco Pharma has an impressive story to tell here.

Back in 2019, Natco’s total borrowings stood at ₹386.3 crore, and by 2024, this figure slightly declined to ₹363.2 crore. Over a 5-year period, the borrowings have grown at a negligible CAGR of just 1.20% annually, showcasing the company’s cautious approach to debt.

When we look at the debt-to-equity ratio, it’s at an incredible 0.03—a clear indicator of a near debt-free status. For context, a debt-to-equity ratio below 1 is generally considered healthy, and Natco is far below that threshold.

Fast forward to the current quarter (Q3FY25), and the numbers speak volumes. Natco’s borrowings are at ₹200 crore, but here’s the standout: the company holds ₹3,000 crore in cash reserves! You might now wonder, “Why isn’t the company paying off the debt if it’s sitting on so much cash?”

The management addressed this very question during the Q3FY25 earnings call, and their explanation is rooted in simple but smart math. The borrowing cost for the ₹200 crore debt is 6%, while the deposits they hold earn an 8% return. Breaking an 8% deposit to pay off 6% debt simply wouldn’t make financial sense.

In essence, the company has no debt burden, effectively operates as a debt-free entity, and still maintains a healthy cash position. This prudent financial management further reinforces the strength and resilience of Natco Pharma’s balance sheet.

REVENUE AND PROFIT GROWTH

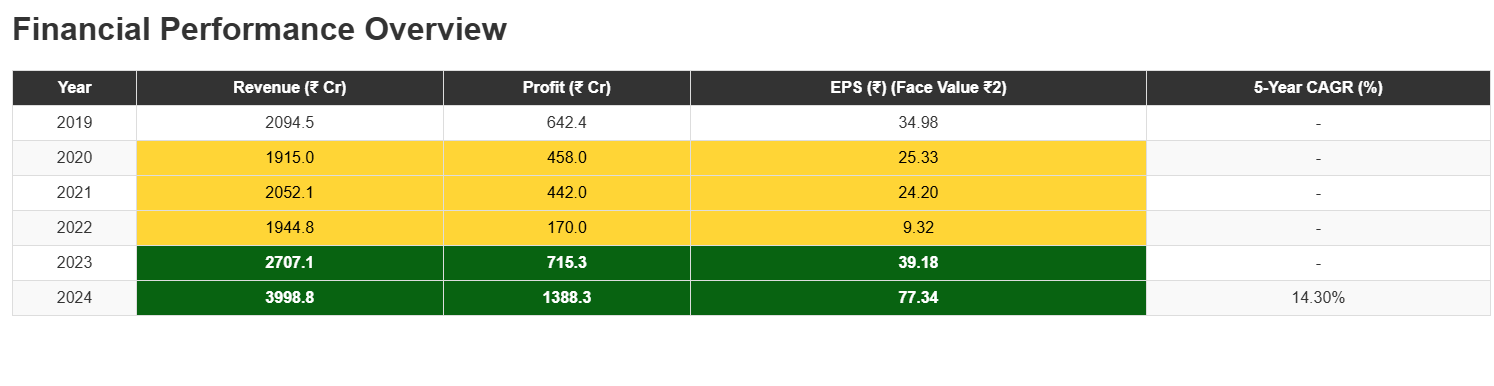

Natco Pharma has showcased impressive growth over the last five years, achieving a 5-year CAGR revenue growth of 13.93% annually and an even more remarkable profit CAGR of 16.58%. For a company of Natco's scale, this is no small feat—it’s a testament to its strong business strategy and execution.

To put things into perspective, in 2019, Natco's revenue stood at ₹2,094.5 crore, with a profit of ₹642.4 crore. Fast forward to 2024, and the company’s revenue has nearly doubled to ₹3,998.8 crore, with profit surging to ₹1,388.8 crore. This stellar performance has undoubtedly raised a question in your mind:

What caused this sudden and massive spike in revenue and profit, especially during 2023 and 2024?

The answer lies in a single blockbuster product: Revlimid.

What is Revlimid?

Revlimid (Lenalidomide) is a groundbreaking drug developed by Celgene Corporation (now part of Bristol-Myers Squibb). It is primarily prescribed for the treatment of multiple myeloma (a form of blood cancer) and other serious blood disorders.

Revlimid has been a multibillion-dollar product globally, thanks to its unparalleled efficacy and high demand. For years, however, its lucrative market was protected by robust patents, which kept generic manufacturers at bay.

But Natco Pharma had other plans.

How Natco Pharma Broke the Monopoly

The journey to Revlimid's success was anything but easy for Natco. The company, in collaboration with its U.S. partner, Teva Pharmaceuticals, strategically challenged Celgene’s patents on Lenalidomide in the U.S., initiating a lengthy legal battle. Here’s how Natco emerged victorious:

Patent Challenge: Natco, leveraging its legal expertise, argued that Celgene’s patents on Lenalidomide were overly broad and non-innovative. This legal battle continued for years.

Settlement Agreement: In 2015, after protracted negotiations, Natco and Celgene reached a settlement agreement. Under this deal:

Natco was allowed to launch its generic version of Revlimid in the U.S. market starting in March 2022.

The agreement imposed volume restrictions initially, gradually increasing Natco's market share over the years until January 31, 2026, when all restrictions would be lifted.

A Landmark Moment for Natco

In March 2022, Natco launched its generic Lenalidomide (Revlimid) in the U.S.—a historic achievement for the company. The U.S. is the largest pharmaceutical market globally, and even with volume restrictions, the revenues generated from this product were nothing short of transformational.

By 2023 and 2024, as volume restrictions eased, Revlimid sales surged dramatically, becoming the primary driver of Natco’s financial performance. The drug contributed a lion’s share to the company’s record-breaking revenues and profits during this period.

DOWNFALL AND RECOVERY

While revenue and profit growth often steal the spotlight, they don’t always tell the complete story behind a company’s performance. A closer look at Natco Pharma’s financials reveals the challenges and turning points that shaped its journey.

Take 2022, for instance. The company’s profit dropped sharply to ₹170 crore, a staggering 62% decline from the previous year’s ₹442 crore. Interestingly, this steep fall in profitability occurred despite only a slight dip in revenue. What triggered such a dramatic drop?

The primary culprit was a significant inventory write-off of ₹232 crore, a result of misjudged investments in high-value raw materials and products that failed to meet anticipated demand during the pandemic. This was further compounded by a receivables write-off of ₹47 crore, which added to the financial strain.

These challenges arose from supply chain disruptions, shifting demand patterns, and the unpredictability of the pandemic. Although Natco attempted to adapt to the circumstances, not all of its investments paid off. Adding to this were pricing pressures in the oncology segment and heightened competition, which squeezed margins even further.

After the challenges of 2022, 2023 marked a game-changing year for Natco Pharma. The launch of Revlimid, a blockbuster generic cancer drug, catapulted the company’s profitability to new heights. With this breakthrough, Natco’s financial performance took off like a rocket, solidifying its position as a major player in the pharmaceutical industry.

So far, we’ve explored the ups and downs of Natco Pharma’s journey—its triumphs and challenges that shaped the company. Now, let’s shift gears and look ahead to what the future holds.

Excitingly, Natco Pharma has an intriguing pipeline of opportunities that could redefine its growth trajectory. However, not all is rosy in the immediate term. In the current quarter (Q3FY25), the company faced a major setback as its share price nosedived by 20%, catching many investors off guard.

What caused this crash? And how does Natco plan to bounce back? Stay tuned as we delve deeper into the company’s plans, strategies, and how it aims to overcome market volatility while building a brighter future.

FUTURE PIPELINE AND [20%] CRASH

In Q3FY25, Natco Pharma reported a profit of just ₹132 crore, a sharp 80% decline compared to the previous quarter's ₹676 crore. What makes this even more concerning is that the reported profit included a ₹90 crore one-time gain from the sale of land. If you exclude this one-time gain, the profit decline was closer to 50-60%.

The primary reason behind this steep drop? A complete halt in sales of Revlimid, Natco's blockbuster drug that had been the backbone of its revenue. With price erosion now underway, the question looms large: What comes after Revlimid?

But before diving into the future, we must first understand the business model of Natco Pharma. A deeper look into how the company operates will provide better clarity on its strategy and resilience in navigating this critical phase.

THE FLUCTUATION OF DRUG

Natco Pharma has built its success on blockbuster generic drugs like Gleevec, Sovaldi, Copaxone, and Abilify. These drugs have provided significant revenue opportunities, especially during their exclusivity periods. However, this success comes with an inevitable challenge—patent expirations and market erosion.

Once exclusivity ends, competitors flood the market with their own generics, driving prices down and eroding market share. This cyclical pattern is a familiar reality in the pharmaceutical industry, and Natco Pharma has already navigated it with Sovaldi and Abilify—both of which faced intense competition by 2021. As rival generics entered the market, price reductions followed, impacting Natco’s revenue.

Now, history is repeating itself with Revlimid—which has entered its erosion phase. However, Natco Pharma has consistently demonstrated resilience. Its strong pipeline, strategic drug launches, and ability to capitalize on patent expirations have allowed the company to maintain steady revenue growth over the years.

The key question now is: What’s next for Natco Pharma? Given its track record, understanding its future portfolio and upcoming drug launches will be crucial in navigating the next phase of growth.

THE FUTURE PIPELINE

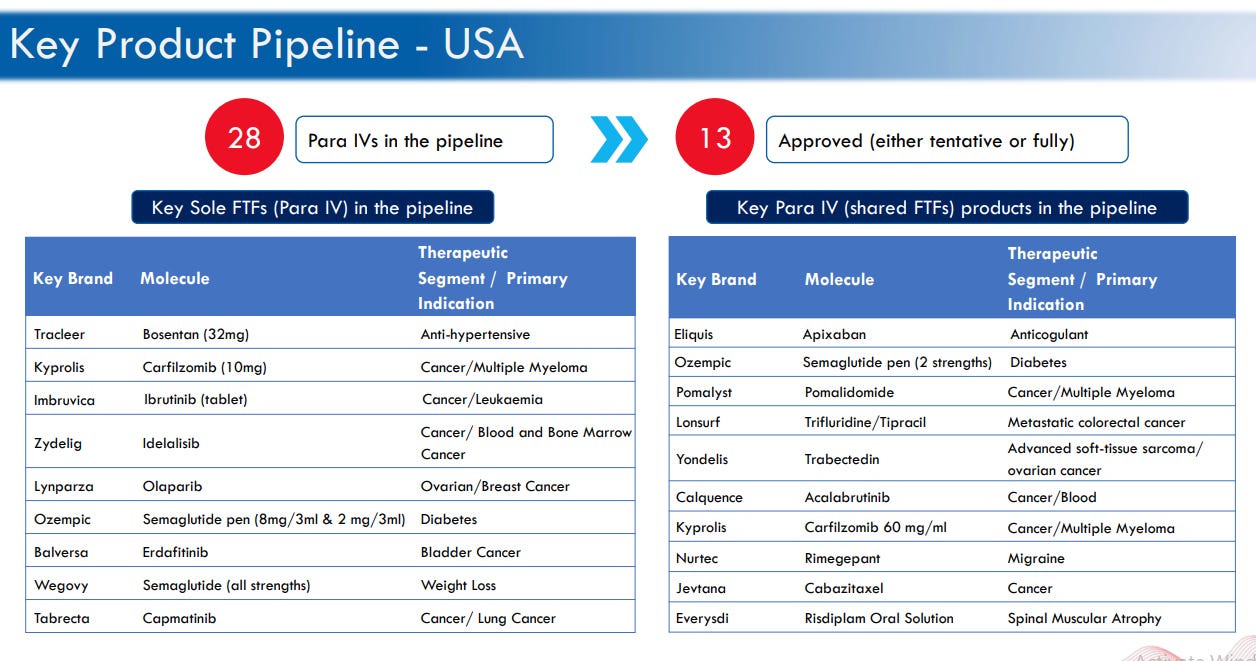

After Revlimid, the next major drug in Natco Pharma’s pipeline is Semaglutide, a blockbuster diabetes medication. Natco is expected to launch Semaglutide in India by March 2026, marking a significant milestone in its portfolio.

Beyond Semaglutide, the company has several other high-potential drugs lined up:

Olaparib – Currently in the approval stage, Olaparib represents a first-to-file opportunity shared 50:50 with Alembic. The approval process is expected to take another 1.5 years, with its launch anticipated thereafter.

Erdafitinib & Capmatinib – Both of these drugs are in the early development stage, positioning Natco for future growth in the oncology segment.

In addition to these major launches, Natco Pharma has a diverse pipeline of smaller drug launches, ensuring a steady flow of new products to support its long-term growth.

GEOGRAPHY AND SEGMENT OF REVENUE

Natco Pharma's main revenue streams come from four key areas:

Main Revenue Streams:

Domestic Formulations

Export Formulations

APIs (Active Pharmaceutical Ingredients)

Crop Health Sciences

Main Revenue Divisions:

Oncology

Diabetology

Cardiology

A significant portion of Natco's revenue is generated from Export Formulations, particularly in international markets, with the USA being a major contributor.

As seen in the table, in FY24, Natco Pharma earned approximately ₹3,236.9 crore from international markets through Export Formulations, accounting for a remarkable 78.4% of total revenue. Within Export Formulations, the Oncology division plays a pivotal role in driving most of the revenue. This highlights the company's strong foothold in global markets, particularly in the high-demand oncology sector.

RATIO ANALYSIS

These comparative ratio numbers are constructed with a high margin of safety. You can adjust them—either increase or decrease—based on your own margin of safety.

VALUATION

Natco Pharma's balance sheet remains robust, with a cash reserve of approximately ₹3,000 crore, reflecting strong financial stability. However, the primary challenge the company faces is the declining sales of Revlimid.

Despite this near-term headwind, our analysis highlights a strong future pipeline, positioning the company for long-term growth. Fundamentally, Natco Pharma remains solid, backed by a healthy cash reserve, strategic drug launches, and a well-managed financial structure.

From a valuation perspective, the company's current P/E ratio stands at 8.49, significantly lower than its median P/E of 26.3, suggesting it is undervalued at present. Moreover, when compared to industry peers, Natco appears to be trading at an attractive valuation.

NOTE: This WhatsApp group is not for recommendations on buying or selling financial instruments; it is solely for educational purposes.

{Caution: This article is for educational purposes only, Please consult a SEBI-registered investment advisor before making any investment decisions. This analysis is solely aimed at teaching the fundamentals of company analysis. }

Interesting article with great analysis. however with Trump talking about 25% tariffs on import from pharma companies, it will be a challenge to Nacto and other pharma companies.

Very good