What’s inside this article?

A deep dive into the history of ITC and how its management has evolved over the years.

Full financial analysis — from balance sheet to profit and loss statement.

A look at portfolio diversification, segment-wise growth, and future prospects.

A complete breakdown of ITC’s current valuation — is it undervalued or fairly priced?

The History and Transformation of ITC Ltd

The Beginning

ITC Limited was founded on August 24, 1910, as the Imperial Tobacco Company of India Limited, a British-owned enterprise and subsidiary of British American Tobacco (BAT). The company began its operations in Kolkata, which remains its corporate headquarters to this day. In a strategic move to reduce dependency on cigarette imports from Britain and capitalize on India’s local climate and logistical advantages, ITC established its first manufacturing plant in Bangalore in 1913. This not only marked the start of domestic production but also laid the foundation for ITC’s future expansion in India.

Following India’s independence in 1947, the company gradually began a process of Indianization. In 1970, it changed its name to India Tobacco Company Limited and in 1974, it adopted a more neutral identity as ITC Limited. This name change was symbolic of the company’s intent to diversify beyond tobacco and reduce its colonial image. Under the leadership of Ajit Narain Haksar, ITC’s first Indian chairman, the company embarked on its first significant diversification strategy. In 1975, it entered the hospitality industry with the launch of ITC Hotels, followed by forays into the paperboards, printing, and agri-business segments. While these moves laid the foundation for a broader portfolio, cigarettes continued to dominate the company’s revenues, contributing nearly 80% well into the 1990s.

The Turning Point: Y.C. Deveshwar’s Visionary Leadership

The true transformation of ITC began in 1996 when Y.C. Deveshwar took over as Executive Chairman. At the time, ITC was battling multiple challenges—legal disputes, including a high-profile FERA case, public perception as a tobacco company, and over 80% of its revenue still tied to cigarettes. There was also strategic tension with BAT, which wanted ITC to stay tobacco-centric.

Deveshwar envisioned a completely different future. He wanted ITC to become a diversified Indian conglomerate that leveraged its strengths in agri-sourcing, supply chain logistics, and rural networks to build businesses beyond tobacco. He focused on creating large-scale livelihoods and sustainable growth. Unlike competitors that acquired brands, Deveshwar chose to build new ones from scratch, signaling ITC’s commitment to long-term value creation. Over the next two decades, the company launched a wide range of brands across the FMCG spectrum—Aashirvaad (atta), Sunfeast (biscuits), Bingo! (snacks), Yippee! (noodles), Classmate (stationery), and Fiama and Vivel (personal care). Aashirvaad alone crossed ₹7,000 crore in annual sales, becoming India’s leading branded atta.

In parallel, Deveshwar invested heavily in ITC’s agri-business through the launch of e-Choupal, a pioneering rural digital initiative that directly connected ITC with millions of farmers. This platform helped procure commodities like wheat, soy, and coffee efficiently, while also empowering rural communities. The hotels division grew into a sustainable luxury brand, and the paperboards and packaging segment modernized to meet global standards.

Under Deveshwar’s stewardship, ITC's transformation was dramatic. Between 1996 and 2017, the company’s market capitalization soared from ₹6,000 crore to over ₹3 lakh crore. Tobacco's share in overall revenue steadily declined, and ITC became a multi-business conglomerate, widely respected for its emphasis on inclusive growth, sustainability, and rural development. His leadership also earned praise for resisting pressure from BAT and maintaining ITC’s Indian identity.

ITC Today: The ‘ITC Next’ Strategy Under Sanjiv Puri

After Deveshwar stepped down, Sanjiv Puri took over as Chairman and Managing Director in 2019 and launched the “ITC Next” strategy. This phase focuses on digital transformation, sharper capital allocation, and unlocking shareholder value. The company adopted an asset-light model for its hotel business and increased investments in technology-driven agriculture and FMCG margin improvement. One major development was the use of ITC MAARS, a digital agri platform that brings together farmers, agri-tech solutions, and market linkages under one roof.

ITC's FMCG business, excluding cigarettes, now contributes over ₹20,000 crore annually and has been growing at a CAGR of around 12–15%. The company has developed over 25+ consumer brands, with six of them crossing ₹1,000 crore in annual sales. In 2023, ITC announced the demerger of its hotel division, aimed at sharper focus and value unlocking. The move was well-received by markets and aligned with ITC’s vision of creating lean, focused businesses under a broader group umbrella.

Where ITC Stands Today

Today, ITC is one of India’s most valuable companies with a market capitalization of over ₹5.1 lakh crore as of 2025. Its revenue comes from multiple streams: FMCG (both food and non-food), agribusiness, hotels, paperboards & packaging, and information technology. The company is a consistent dividend payer with a yield of around 3–4%, making it popular among long-term investors and conservative portfolios.

So far, we’ve understood how ITC has evolved over the decades—from a colonial tobacco importer to a diversified Indian powerhouse. Now, it’s time to go deeper. Let’s begin a full-fledged fundamental analysis of ITC, starting from the top with a detailed industry analysis of the sectors it operates in.

INDUSTRY ANLAYSIS

Why FMCG is the Most Defensive Sector in Indian Equities?

When the stock market turns volatile and economic uncertainty increases, the Fast-Moving Consumer Goods (FMCG) sector has consistently stood out as one of the most resilient and defensive segments of the Indian equity market. Unlike cyclical industries such as automobiles and banking, which suffer steep drawdowns during crises, FMCG stocks tend to remain relatively stable, offering protection to investors when most other sectors bleed.

The COVID-19 market crash in March 2020 clearly demonstrated this defensiveness. On April 3, 2020, while the Nifty Auto index had fallen by 46.78% and Nifty Bank had declined by 44.94% from their earlier highs, the Nifty FMCG index dropped only by 11.96%. This significant outperformance was not a coincidence—it reflected the essential nature of the goods these companies sell. Even in times of lockdowns and panic, consumers continued to purchase basic necessities such as atta, rice, soap, toothpaste, biscuits, and sanitizers. These are non-discretionary items that people simply cannot do without, regardless of their financial situation. While a family might postpone buying a car or cut down on entertainment expenses during tough times, they cannot stop buying food, cleaning products, or personal hygiene items.

The defensiveness of FMCG stocks comes from this inelastic demand. Consumers may downtrade to cheaper brands or reduce quantities, but the volume demand for essentials remains steady. This leads to stable cash flows for FMCG companies, making them attractive to both retail and institutional investors during downturns. Moreover, many FMCG companies operate with low debt, high return on equity (ROE), and regular dividend payouts, making them even more appealing in uncertain economic environments.

From 2019 to 2024, the FMCG industry in India has grown at a compound annual growth rate (CAGR) of approximately 9% to 11%, supported by rising rural demand, urban premiumization, and a shift toward branded goods. The rural segment now contributes over 36% of FMCG sales, and with increasing government focus on rural development, this share is expected to grow further. Simultaneously, the rise of e-commerce and quick commerce platforms like Blinkit, BigBasket, Zepto, and Amazon Pantry have expanded FMCG’s digital reach, helping companies maintain sales momentum even when offline retail was shut during the pandemic.

FMCG RETURNS

While FMCG may not always deliver the explosive returns that tech or cyclical stocks offer during bull markets, it provides steady, reliable compounding over the long term. Investors view FMCG as a capital-preserving sector, one that pays regular dividends and offers lower volatility. During bear markets, FMCG is often the last sector to fall and the first to recover, making it a natural hedge against market downturns. In a portfolio context, FMCG stocks are like an umbrella—not glamorous, but invaluable when the storm hits.

In conclusion, the FMCG industry remains one of the most attractive investment themes for those seeking consistency, capital protection, and gradual wealth creation. Its unique blend of essential product offerings, strong brand power, efficient supply chains, and resilient margins make it the cornerstone of a defensive portfolio, especially during uncertain times.

Alright, now let’s take a look at how ITC has performed over the years—and see if it’s still worth investing in today. So let’s first start with the balance sheet analysis of ITC.

FINANACIAL STATEMENT ANALYSIS OF ITC

BALANCESHEET ANALYSIS

Let’s start with the foundation—ITC’s balance sheet. When analyzing any company, except for those in the banking or finance sector, one golden rule stands out: check the debt levels. Why? Because companies with low or no debt often enjoy more financial flexibility, face less risk during downturns, and have greater freedom to reinvest in their growth.

Now let’s look at ITC. Back in 2019, the company had total borrowings of just ₹83.42 crore. Sounds modest, right? But here’s what’s impressive—its cash and bank balance that year stood at a whopping ₹4,152.03 crore. That’s almost 50 times more cash than debt! In simple terms, ITC could’ve paid off its entire borrowings without breaking a sweat—and still had billions left.

Fast forward to 2025, borrowings have gone up slightly to ₹529.81 crore, while cash and bank balances stood strong at ₹4,012.36 crore. Even now, ITC holds nearly 7.6 times more cash than debt—still a very comfortable cushion. This disciplined approach to managing debt is a sign of robust financial health. If you look at the debt-to-equity ratio, it’s consistently at zero. That’s right—zero. ITC has effectively remained debt-free, a rare and commendable feat for a company of its size. In a world where many businesses rely on loans to expand, ITC has done it the smart way—using its own reserves.

But that’s not all. Let’s talk about the current ratio—a simple yet powerful metric that shows how easily a company can pay off its short-term obligations. It’s calculated by dividing current assets by current liabilities. In 2025, ITC had current assets worth ₹43,893.28 crore and current liabilities of ₹14,334.11 crore. That gives us a current ratio of around 3. Translation? For every ₹1 ITC owes in the short term, it has ₹3 ready to pay it off. Anything above 1.5 is considered healthy, and ITC’s 3x coverage is a testament to its strong liquidity position.

To wrap it up, ITC is standing on rock-solid financial ground—debt-free, cash-rich, and highly liquid. It’s a company that doesn’t just survive, it thrives—even when the winds turn rough.

Now, let’s dive into ITC’s Profit and Loss Statement to see how their revenue and profit have evolved over the years. Trust me, there’s a lot to uncover.

Join as a paid subscriber to unlock a whole lot more — including all past premium articles and exclusive access to our WhatsApp group for paid members.

Click the button below to start getting the full benefits ⬇️

PROFIT AND LOSS STATEMENT ANLAYSIS OF ITC

Now let’s move on to the heart of every company’s performance—the Profit and Loss Statement.

Back in 2019, ITC’s total income stood at ₹52,035.90 crore. Then came the storm—2020 and 2021—the dreaded COVID-19 era. While countless companies were drowning in losses, ITC remained remarkably steady. There were no dramatic drops, no red flags. It didn’t just survive; it held its ground and kept moving forward. Even in those uncertain times, ITC posted steady (albeit slow) growth. That’s the mark of a resilient business.

Fast forward to 2025, ITC clocked a total income of ₹84,142.47 crore. That’s a growth at a compound annual growth rate (CAGR) of 9.20% over six years. For a mature giant like ITC in the FMCG space, that’s not just good—it’s impressive. Remember, we’re not talking about a startup scaling from zero. We’re talking about a titan already generating tens of thousands of crores in revenue and still growing consistently.

But let’s not stop at revenue—let’s talk about the real deal: profits.

In 2019, ITC posted a profit of ₹12,835.90 crore. Then came COVID. While many companies struggled to stay profitable, ITC held up well. In 2021, profits dipped slightly to ₹13,382.88 crore—lower than the previous year, but the decline was barely noticeable. Given the global chaos, that’s an outstanding performance. That’s the power of a defensive FMCG portfolio—people may cut luxury, but essentials stay.

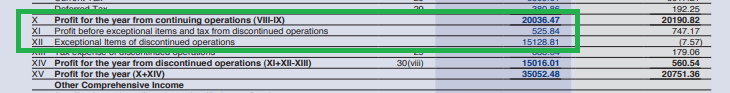

Now let’s leap to FY25. On paper, the profit figure looks jaw-dropping—₹35,052.42 crore. Sounds incredible, right? But hold on, there’s a twist. A big chunk of that profit—₹15,128.81 crore—is a one-time gain from the ITC Hotels demerger. So, when we exclude that exceptional item, the core profit from continuing operations stands at ₹20,036.47 crore.

Now here’s something interesting—and important.

Compare that to FY24, and you’ll notice something unusual. In FY24, ITC’s net profit was higher than its FY25 profit from continuing operations. That means, excluding the one-time gain, ITC actually saw a degrowth in profits in FY25. Yes, you read that right—a slight decline year-on-year.

So what happened?

The answer lies in the broader weakness in the FMCG sector. Demand across both rural and urban markets remained muted. Consumer spending didn’t pick up the way companies had hoped, and essentials saw lower volume growth. It wasn’t just ITC that felt the pinch—giants like HUL, Nestlé, Dabur, and Marico also reported degrowth or flat profits during the same period.

In other words, this wasn’t an ITC problem—it was a sector-wide consumption slowdown.

But even in this challenging environment, ITC remained fundamentally strong. One thing it never fails to deliver is cash flow. Year after year, it has consistently generated positive cash flow from operations. In FY25 alone, ITC posted a free cash flow of ₹15,524 crore. That’s real money in the bank, not accounting trickery. And it gives ITC the flexibility to reinvest, reward shareholders, or weather downturns with ease.

So, to sum it up—yes, there was a profit dip in FY25 (adjusted for exceptional gains), but the company’s underlying strength hasn’t wavered. It remains cash-rich, debt-free, and operationally efficient.

Now that we’ve decoded ITC’s earnings power, let’s move to something equally important—revenue diversification. ITC has long been working to reduce its dependence on cigarettes. But how far has it really come? Let’s explore its evolving portfolio and where the business stands today.

PORTFOLIO DIVERSIFICATION OF ITC

We can broadly divide ITC’s revenue into 5 key segments:

Cigarette Business

FMCG (Non-Cigarette) Business

Agri Business

Paperboards, paper and packaging

Hotels and Infotech Services

Now let’s dive into the growth and revenue diversification of ITC’s portfolio. Let’s break it down and see how each business has evolved over the years!

1.Cigarette Business

When we talk about ITC, one thing is clear—cigarettes are the company’s cash cow. This segment doesn’t just bring in the highest revenue, it also delivers the fattest profits.

Back in FY2020, ITC earned ₹23,679.13 crore from its cigarette business, making up 45.67% of the company’s total revenue. Fast forward to FY2025, that number jumped to ₹35,893.57 crore, still holding a strong 44.34% share of total revenue. That’s a steady 5-year CAGR of 8.68%—not bad for a segment under constant pressure.

Now, let’s address the elephant in the room—can this growth continue for the next 10 years? That’s a tough call. The cigarette industry is one of the most heavily taxed and tightly regulated sectors in India. Government policies, health campaigns, and increasing social awareness are all working against it. So yes, while it has grown steadily so far, there’s no guarantee the same pace will continue over the next decade.

But here’s what makes ITC stand out: they’re not blindly relying on this one business. They’ve built a strong moat in cigarettes—holding around 80% market share—but they’re smartly using the cash from this segment to fuel growth in other areas. FMCG, agri, hotels, and paperboards are no longer just side businesses—they’re becoming core engines of the future.

So, while cigarettes may still be king today, ITC is already building its tomorrow. And to truly see that transformation in action, let’s take a closer look at how its FMCG business has evolved over the years.

2. FMCG BUSINESS

Let’s now take a closer look at one of ITC’s most promising growth areas—its FMCG business.

Back in FY20, this segment contributed ₹12,843.99 crore to the company’s top line, accounting for about 24.77% of total revenue. Fast forward to FY25, FMCG revenue almost doubled to ₹22,005.27 crore, growing at a healthy CAGR of 11.37% over five years. Its share in total revenue also rose to 27.17%, reflecting the steady shift in ITC’s business model from being cigarette-led to more consumer-focused. This transition, though gradual, signals a conscious strategy to build a diversified and resilient portfolio.

The company’s FMCG portfolio includes several well-known brands across categories—Aashirvaad in staples, Sunfeast in biscuits and bakery, Yippee! in noodles, Bingo! in snacks, Fiama and Vivel in personal care, Classmate in stationery, and Mangaldeep in agarbattis. These brands enjoy decent market positions and wide consumer acceptance.

In addition to organic growth, ITC has been actively expanding its FMCG footprint through strategic acquisitions and investments. In June 2025, it completed the acquisition of Sresta Natural Bioproducts, known for its 24 Mantra Organic brand—strengthening its entry into the growing organic food segment. Earlier in April 2025, it acquired a 43.67% stake in Ample Foods, a company operating in the frozen and ready-to-cook food segment with brands like Prasuma and Meatigo.

ITC has also increased its investment in Mother Sparsh, a digital-first natural baby and personal care brand. As of 2025, ITC holds a 49.3% stake in the company, up from its earlier 16% stake acquired in 2021. This move helps ITC tap into the premium and ayurveda-based personal care space, particularly in the growing D2C segment.

Overall, ITC’s FMCG business has grown meaningfully over the past few years, driven by a mix of brand-building, innovation, and targeted acquisitions. It is now better positioned to contribute significantly to the company’s future growth, offering more stability and scalability beyond cigarettes.

Now that we’ve seen how ITC is building its consumer business for the future, let’s turn our attention to another key pillar in its portfolio—the Agri Business—which plays a strategic role in enabling both supply chain efficiency and rural sourcing.

3. AGRI BUSINESS

The Agri Business segment is also one of the fastest-growing pillars in ITC’s portfolio. Back in 2020, it generated ₹5,912.54 crore in revenue, contributing around 11.41% to the company’s total revenue. Fast forward to 2025, this segment has nearly doubled its performance—clocking ₹12,244 crore in revenue and contributing a solid 15.12%. What’s even more impressive? It grew at a remarkable CAGR of 15.07% over the last five years. Clearly, ITC’s agri push is paying off big time!

Now, let’s move on to the next segment in ITC’s portfolio—the Paperboards, Paper & Packaging business. Let’s see how this segment has evolved over the years.

4. Paperboards, Paper & Packaging business.

The Paperboards, Paper & Packaging business currently contributes around 8.12% to ITC’s total revenue. In FY25, this segment recorded a revenue of ₹6,575.88 crore. Over the past five years (2020 to 2025), it grew at a CAGR of 7.89%, showing stable and consistent performance.

Looking at future plans, ITC has proposed the acquisition of the pulp and paper undertaking of Aditya Birla Real Estate Limited, which could help strengthen its supply chain and improve efficiencies.

Overall, this segment is moving steadily and seems well-positioned over the long term.

Now let’s move on to the final segment in ITC’s portfolio—the Hotels and Infotech business.

5. HOTEL AND INFOTECH BUSINESS

Currently, ITC’s hotel business has been demerged, and now operates as a separate entity. But ITC still holds a 39.88% stake in ITC Hotels, so it continues to be part of the game.

Now let’s get into the numbers.

The Hotel and Infotech business has been the lowest revenue contributor in ITC’s portfolio. As of FY25, it contributed around 5.22% to total revenue. But if you look back, during 2020 to 2024, this segment was contributing only 3% to 4%—so there’s clearly been progress.

In terms of revenue, it generated ₹4,224.04 crore in FY25. But the real story here is the growth. From 2020 to 2025, this segment delivered an amazing CAGR of 17.18%, making it the fastest-growing segment in ITC’s entire portfolio.

So overall, whether it's cigarettes, FMCG, agri, paper, or hotels—each segment of ITC is performing well and heading in a good direction, especially when you take a long-term view.

Now, let’s come to the final part—Valuation.

Is ITC still undervalued, or has the market already priced it in?

Let’s get into it.

VALUATION

Looking at the current financials, ITC appears fundamentally strong and growth-oriented, with a management team steadily reshaping the company in the right direction. As of now, ITC is trading at a P/E ratio of around 15, which might look extremely attractive at first glance—but it’s important to note that this figure is skewed due to the one-time gain from the demerger of ITC Hotels.

If we exclude that exceptional gain, the adjusted P/E works out to around 26, based on an EPS of approximately ₹16.08. When we compare this to ITC’s 5-year median P/E of 23.6, Based on the median comparison, ITC still appears reasonably valued.

Now, let’s assume a conservative growth rate of 8% over the next five years. As shown in the earlier table, this would project ITC’s EPS to reach ₹23.62 by FY30. Even if the P/E remains at its current adjusted level (~26), the potential upside in price becomes quite apparent.

What makes the case stronger is the valuation gap when compared to its FMCG peers. While most competitors like HUL, Nestlé, Dabur, Marico, Tata Consumer Products, and Godrej Consumer are trading at P/E multiples in the 50–85 range, ITC—despite its strong brand portfolio, steady growth, and improving FMCG mix—is trading at a much lower band of 25–30.

Moreover, ITC continues to reward shareholders through consistent dividend payouts, typically offering 2%–3% annual dividend yield, which adds a layer of stability and return for long-term investors.

So, whether we evaluate it based on historical valuations, peer comparison, or future growth potential, ITC currently looks undervalued on multiple fronts.

Join as a paid subscriber to unlock a whole lot more — including all past premium articles and exclusive access to our WhatsApp group for paid members.

Click the button below to start getting the full benefits ⬇️

NOTE: This WhatsApp group is not for recommendations on buying or selling financial instruments; it is solely for educational purposes.

{Caution: This article is for educational purposes only, Please consult a SEBI-registered investment advisor before making any investment decisions. This analysis is solely aimed at teaching the fundamentals of company analysis. }

Thank you Bro.

That was an awesome analysis bro,

This is my personal view and it may sound pessimistic.

Disclaimer - I too hold a large portion of ITC in my portfolio and still adding on.

FMCG

The only thing that come in to my concern is that the consumer shift back towards organic products in FMCG.

I see many organic pop up stores doing good sales with high margin.

Lots of ayurvedic medicinal stores doing a good sales with high margin where people flock around.

Also as a consumer, I see parents opting healthy options for kids like fresh juices rather than Noodles and biscuits.

On positive note ITC is expanding its FMCG business globally and that would bring the profits.

CIGARETTE

Coming to Cigarette a data shows the Gen Z smoking rates are generally lower compared to older generations.

It's a heavily government regulated industry and the government may cut the cash cow of ITC any time.

Also the WHO has asked the governments world wide to increase the sin tax by 50% minimum.

Apart from this the smuggled & duplicate Cigarettes are major caveat for ITC.

PAPERBOARDS, PAPER & PACKAGING BUSINESS

Paper packing business is heavily derived from cutting down trees and as we see and due to climatic changes the raw materials may become expensive and scarce, cutting down the margins.

Also the new startups which bring decomposable packing materials may gain traction and lots of R&D is happening in this segment which may disrupt the whole packing industry soon due to climatic change.

Also this is a heavy power consuming industry and even though ITC has its own green power to support its packing business, power would be costing high to very high in coming days due to EV Revolution.

HOTEL

Regarding Hotel, its a luxury class hotel which would be occupied due to K-Shape recovery in India.

The caveat here is it has high capital and operating costs.

INFOTECH

Infotech - already we see a slowdown in IT due to recession and AI.

It's self explainable so I didn’t deep dive in to it.

AGRI

Here we see future growth as American Investor “Jim Rogers” said future is for hard assets and agri.

But the caveat here is even though ITC exports many products like Chilli, Turmeric, Cumin, Coriander, Pepper, Fenugreek, Fennel, Mustard, etc.

Its major export is raw leaf tobacco.

Conclusion

I really sometimes feel is ITC overhyped because, I don’t know a single investor who does not hold ITC in their portfolio and everyone talks about it in Investing field.

Even though am optimistic about ITC there are the pessimistic caveats that run back of my mind often.

No offence - just shared my thoughts.

If wrong, my apologies and please correct me where am wrong.

—

Thanks & Regard,

Kathir Azhagan.

Bahut badiya, Keep it Up...😊